Welcome to Hood MWR!

Hoodmwr is a blog that talks about fashion and what celebrities wear. The site mainly concentrates on shoes, outfits, what celebrities wear, sports and fitness, work, and travel.

Celebrities’ Heights

The Famous People

The Celebrity Hairstyles

Most Popular Online Calculator

WHAT’S NEW

Top 50 Iconic Short Hair Celebrities with Beauty and Influence

Short hair is no longer strange to many celebrities over the years. Short hair highlights youthful…

Top 50 Celebrities With Curly Hair in 2023

The soft, bouncy curls falling on the soft shoulders of Hollywood famous must have inspired many…

Top 35 Cristiano Ronaldo’s Hairstyles Through the Years

Cristiano Ronaldo is well known for his iconic hairstyles, often changing his look on the regular.Throughout…

Top 21 Beautiful Female Celebrities With Short Hair

Long, luscious hair is not always necessary for a glamorous celebrity hairdo. The pixie cuts popularized…

Top 20 Famous Ladies with Bleach-Blonde Hair

The stunning girls on this program frequently flaunt their gorgeous sun-kissed hair, in contrast to several…

85 Handsome Brad Pitt Hairstyles: Confidence and Transformation

As an expert in the field, I would be delighted to delve into the mesmerizing realm…

80 Redheaded Actors and Actresses: List of Famous People

Red hair is a unique and uncommon feature that stands out individuals from the crowd. If…

70 Jennifer Lopez Hairstyles Over The Year

Jennifer Lopez, also known as J.Lo, is a renowned icon in the entertainment industry who has…

51 Famous Actresses With Black Hair

Black hair is often seen as a symbol of strength, beauty, and style. From Rihanna to…

50 Most Beautiful Redhead Actresses You’ll Fall For (2023 Updated)

According to many sources, the percentage that a person is born with a natural redhead is…

50 Most Beautiful Celebrities With Brown Hair In 2023

Brown Hair is a trend that has been going on for a while now, but its…

50 Hottest Male Celebrities With Long Hair

Stunning and elegant, long hair is the pinnacle of style for gentlemen. Some say it’s a…

50 Gorgeous Celebrities With Black Hair

Can you keep up with celebrity hair trends? It seems every other week, there’s something new,…

50 Celebrities Who Prove Pixie Cuts Are Always in Style

Try cutting through a pixie if you are wondering about changing your hairstyle. Pixie is a…

46 Most Wonderful Neymar Hairstyles

Neymar is no stranger to experimenting with his hairstyles. The Brazilian soccer great has worn numerous…

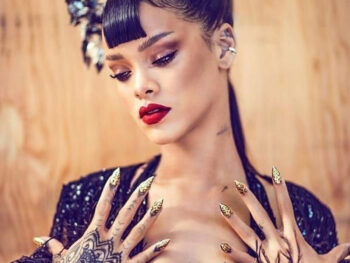

40 Rihanna Hairstyles and Haircuts Ideas in 2023

Robyn Rihanna Fenty is known as Rihanna who is currently a singer, songwriter and actress. There…

40 Most Influential Hair Stylists of All Time

Are you searching for some reliable individuals to make changes to your look? This list of…

40 Most Handsome Basketball Players With Modern Hairstyles in The League

Hair is a huge deal these days, including the hair on a basketball player’s head. With…

40 Gorgeous Taylor Swift Beautiful Hairstyles 2023

Taylor Swift is well known for her stylish and ever-changing hairstyles. Over the years, she has…

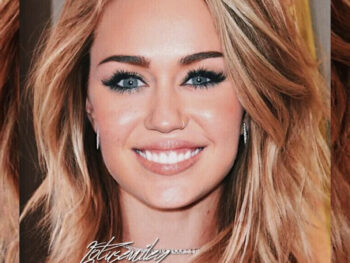

35 Stunning Miley Cyrus Hairstyles: Boldness & Creative

Miley Cyrus, the renowned American singer, songwriter, and actress, has consistently made waves in the fashion…

35 Kris Jenner Hairstyles, Haircuts & Colors

Kris Jenner is one of the most iconic celebrities in the world, and her hairstyles have…

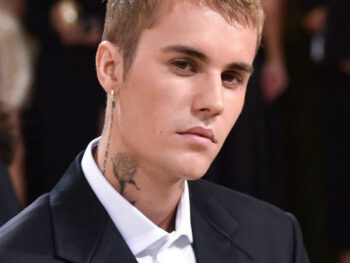

35 Justin Bieber Hairstyles: Different Types of Iconic Haircuts

Justin Bieber is not only known for his music but also for his iconic hairstyles that…

35 Jennifer Aniston Hairstyles to Inspire Your Look

Jennifer Aniston, a beloved actress and style icon, has mesmerized audiences not only with her acting…

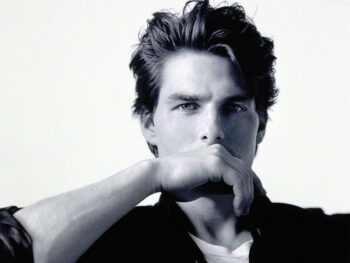

35 Hottest Tom Cruise Hairstyles In 2023

Tom Cruise is an American actor and producer who has been one of the most prominent…

Featured Articles

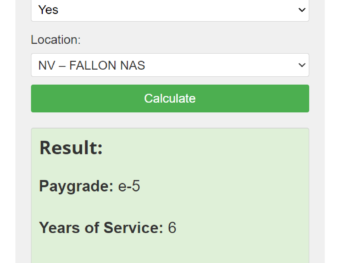

Calculators

Fitness and Health Calculators

Have you ever had a situation where you need to do a calculation, see the effect of two different treatments on patients, or compare two stats? Running a complicated statistic is not as straightforward as it may seem. Just ask yourself if what you are doing is worth the headache. It is much easier to use some calculators online which are accessible from any device.

Body fat calculators are handy tools that can be used in person or online. They’re designed to provide an estimate of your current amount of body fat as well as your target goal according to the fitness guidelines established by the U.S.

The army body fat calculator calculates how much body fat you would have if you were in the United States Army. It also includes a pie chart to show whether your BMI is within an acceptable range. A BMI below 18.5 indicates that you are underweight and an ideal weight range for soldiers is 21-26 for women and 27-30 for men.